Scenario planning is a huge part of business planning. Understanding the cash impact of different decisions is vital to making sure that your plans work out and that you achieve your goals. On the flip side, building scenarios for what could happen if you lose a client or get paid late will help you make plans to guard against a cash gap.

Float is more than just a cash flow forecasting tool, it also provides essential business and cash management features that help you and your business on the path to success.

Check out this video on how scenario planning can help your business, and how to do it in Float:

Scenarios can be created for any alternate reality that you’d like to see in your business. What you change in a scenario will never be reflected in your base, or official, forecast. So there’s no limit to what you can do with your potential plans and you can let your imagination run wild.

Scenarios for various plans

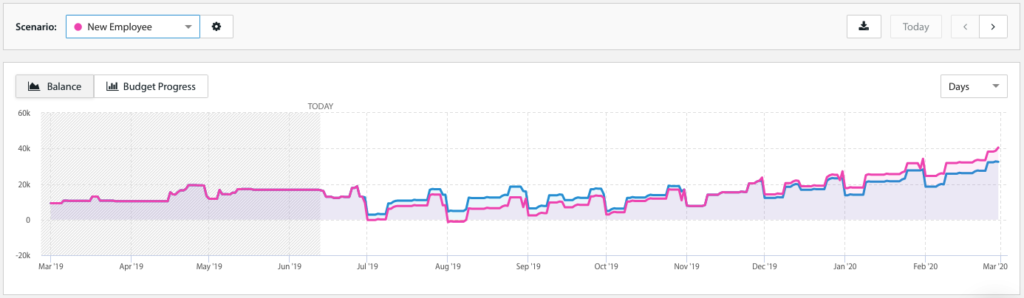

Hiring a new employee

Most businesses don’t just have the cash in the bank to hire a new employee without having to factor in the additional expenditure without a worry. So, when it comes to making a hiring decision, it’s always important to factor that into your cash flow.

When looking to create a scenario for hiring a new employee, here are the basic changes you’ll need to make to see it accurately represented in the scenario:

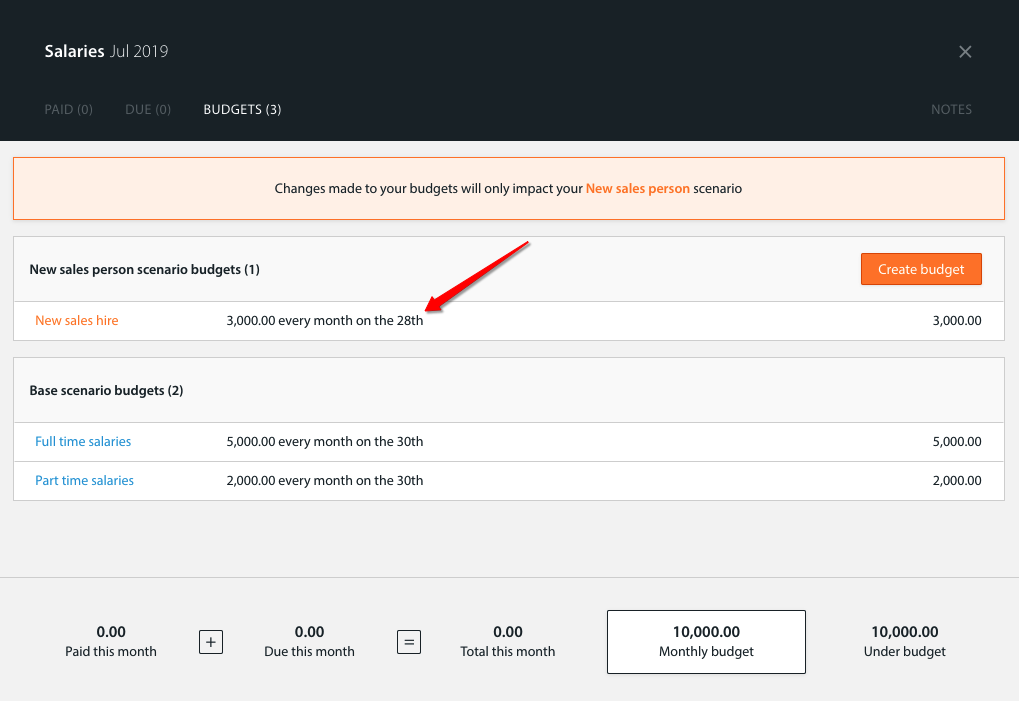

- Go to your Salaries/Payroll line.

- Choose the cell for the month you’d like to make the hire.

- Enter a new budget for the salary and then choose when in the month it will be paid.

Don’t forget to add on taxes related to payroll, such as PAYE and National Insurance if you’re in the UK.

Hopefully, with a new employee, you’ll expect more cash in, (potentially after a probation or training period) so don’t forget to update that line, too.

Planning for a new hire into the business means that you can secure sustainable growth.

A Decrease in Sales

Sometimes, even the best-laid plans just don’t work out.

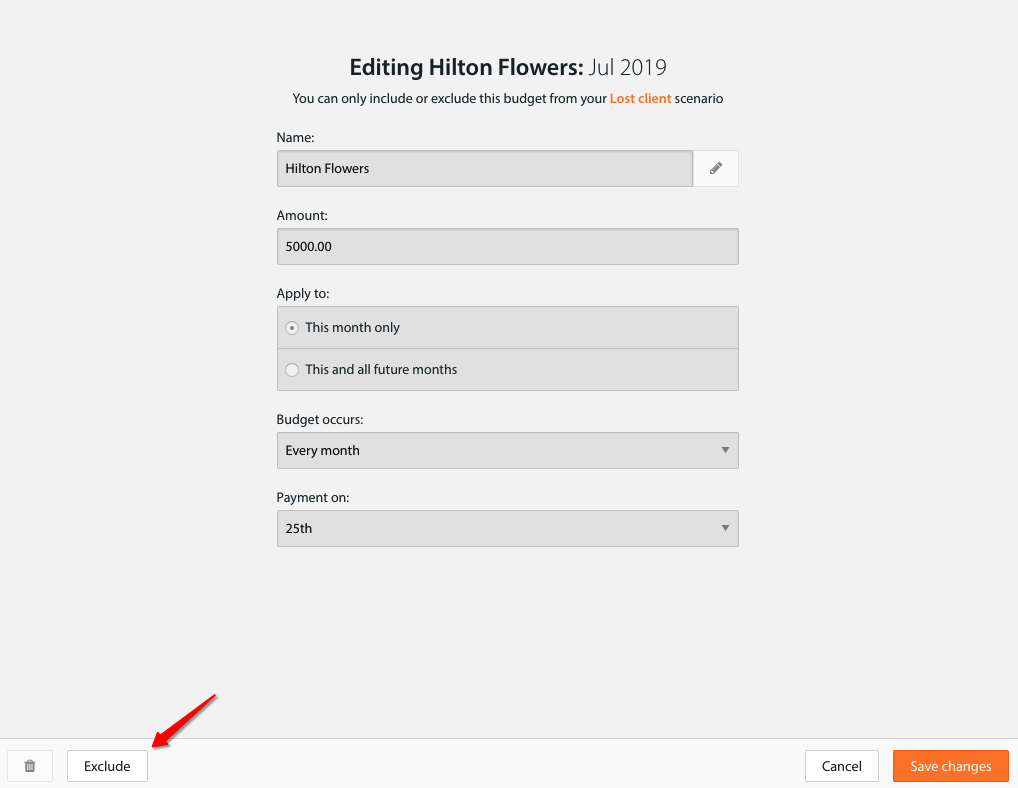

If you have a client that you think might be thinking about moving on, it’s good practice to forecast for a decrease in revenue from that particular client to understand the impact on your cash.

To do so, go to the accounts in your Cash In section where revenue for that client flows in.

Selecting accounts to exclude them from your cash flow is the easiest way to do this.

Simply click on the account in question, find the Budget(s) you want to exclude and select them.

In the bottom left-hand corner, you’ll see a small button labelled ‘Exclude’, alongside a delete icon.

To exclude the Budget(s), click the ‘Exclude’ button, and then choose from the pop-up whether you want that to be for just this month, or this and all future months.

Depending on how significant a dip in sales you wish to plan for, you should exclude as many budgets as you think necessary.

This won’t exclude any budgets in your base scenario.

A new project

Taking on a new project at the wrong time can spell disaster for some businesses. So budgeting for a new project can help you to avoid going bust before you get paid.

With most payment terms, you may find that you’re spending a significant amount of money before receiving anything back. So you’ll want to create a scenario to make sure that you’re covered even if you don’t get paid until after delivering the goods.

Make sure to change the budgets in the relevant expense accounts.

Then, be sure to update your Sales line for the amount you think you’ll get paid, in the month you think you’ll actually receive the cash.

It can also be important to budget for any expected overtime your staff may incur during the delivery of the project, so don’t forget to update your Salaries line if necessary.

A best-case scenario

Looking on the bright side of life in business can seem a bit naive. After all, not every business always runs smoothly.

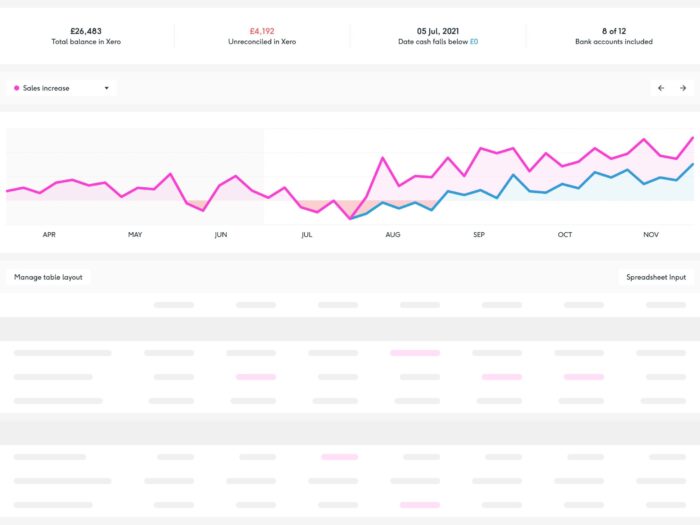

But, it can be a good idea to get an insight into what would happen in your business if everything went from good to great.

So why not include a scenario budget for additional sales, or investment you’re hoping for, and see what the future may look like if all your plans for growth worked out.

A worst-case scenario

Sometimes, it’s good to get an idea of what would happen if everything went wrong. Think of this as your umbrella scenario for a rainy day.

Whether it’s all of your invoices are paid late, ten projects fall through at once, or all of your equipment suddenly breaks and you have to buy more, it’s good to see what the impact would be on your business.

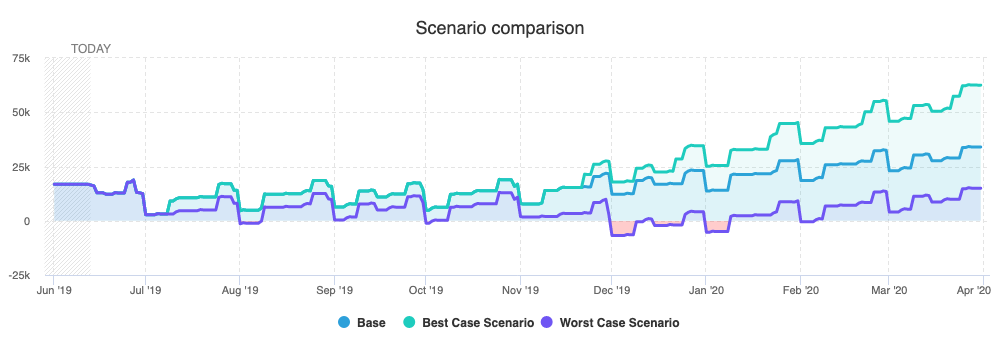

If you’d like to see how your current trajectory measures up to either your best-case or worst-case scenario, then you can go to our Scenario Comparison Report in your Insights tab. Here, you can view multiple scenarios at once and get a real-time view of where your business is heading in comparison to your potential roadmaps.

Whatever your future may hold, it’s always good to get a plan in place to see what may happen.

To find out more about how scenario planning with Float can help you to plan for whatever may come your way, why not log in now, or sign up for an extended free trial until the 31st May to help combat Coronavirus-related cash flow issues?